This guide will walk you through how to configure taxes within Skywire Web Configuration.

Taxes

Taxes rates are configured at the profit center level. Taxes created are then added to a group. Tax Groups are then assigned to products and modifiers. Taxes can be exclusive, inclusive or a flat fee.

How to Configure Taxes

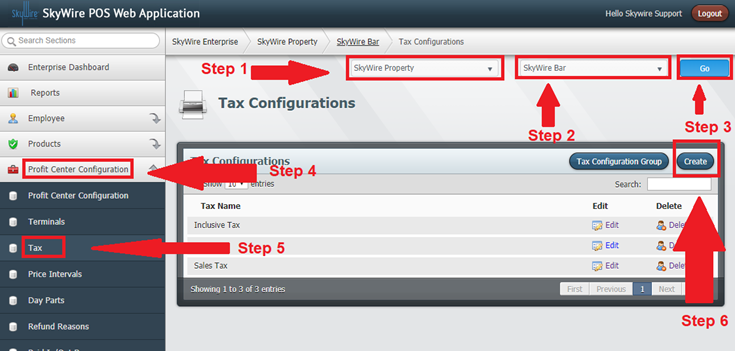

- Select a Property.

- Select a Profit Center.

- Select "Go.”

- Select "Profit Center Configuration.”

- Select "Tax.”

- Select "Create.”

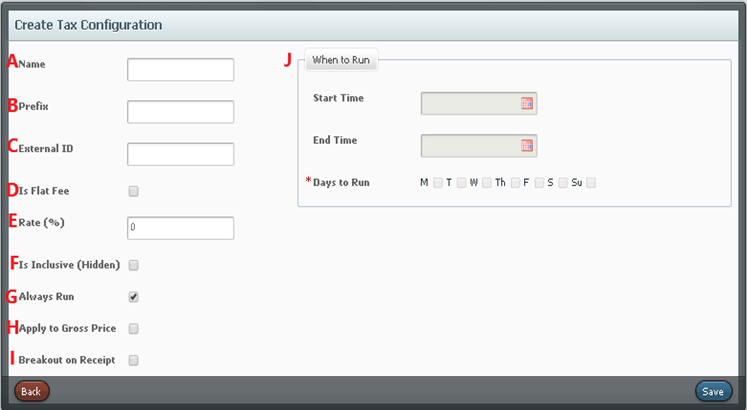

B. Prefix: Enter a prefix for the tax. This will print as a prefix to the product on the printed receipt.

C. External ID: Used for mapping interfaces.

D. Is Flat Fee: Toggle this option if the tax is a flat fee rather than a percentage.

E. Rate: Enter the tax rate percentage.

F. Is Inclusive: Toggle this option if the tax in inclusive (hidden).

G. Always Run: Toggle this option if the tax rate is always applied.

H. Apply to Gross Price: Toggle this option if the tax is applied to the gross price. When this option is not selected the tax is applied to the net price.

I. Breakout on Receipt: Toggle this option if the tax should print on the receipt.

J. When to Run: Enter a time to run the tax if it is not set to always run.

- Select "Save.”

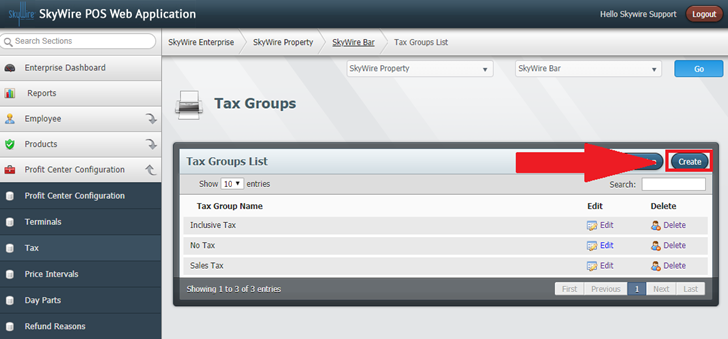

How to Create a Tax Group

- Select "Tax Configuration Group.”

- Select "Create.”

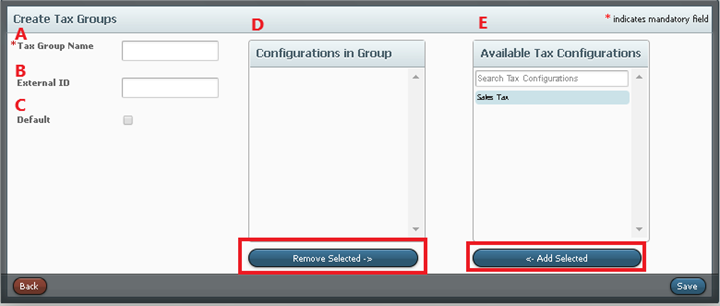

A. Enter the name of the Tax Group.

B. External ID: Used for mapping interfaces

C. Default: Use this to set this tax group as the default

D. Configurations in Group: shows tax configurations that have been added he group. Click “Add E. Selected” under “Available Tax Configurations” to add a configuration to the group.

F. Available Tax Configurations: Tax configurations that are available to be added to the group.

Tax Group Assignments

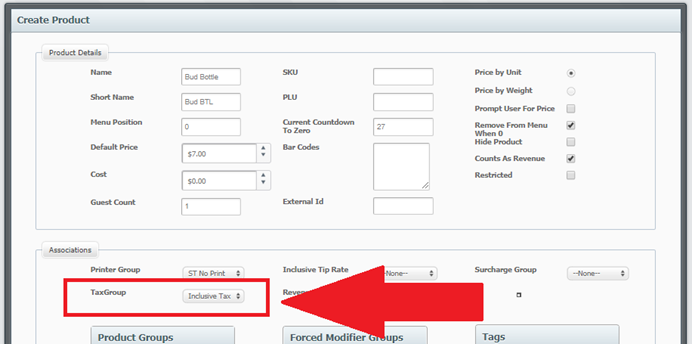

- Tax Groups are assigned to products and modifiers.